Lawmakers and HOAs are working to stop investors in their tracks

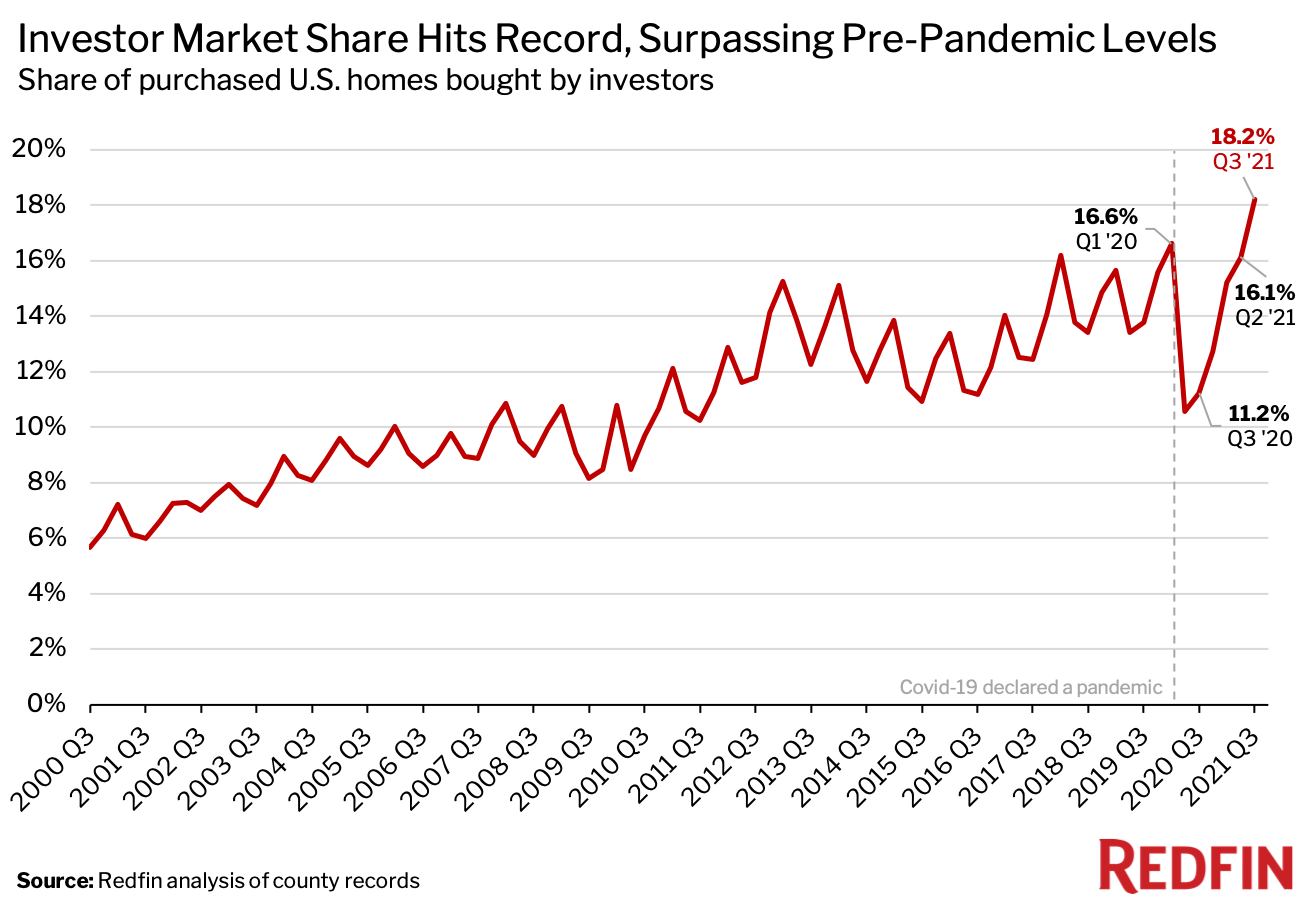

By now, we’ve all heard about investors’ impact on the real estate market, purchasing tens of thousands of single-family homes throughout the U.S. and in this case, California.

For example, in the Los Angeles and Anaheim markets, investors bought one in five homes in the last quarter of 2021, according to Redfin.

Financial markets have been rocky over the past year and, as the saying goes, real estate always appreciates and tends to be a solid hedge against inflation. That’s why we’ve noticed more investors going all-in on residential real estate.

Investors have taken two approaches to their home purchases. Some have played the long game, while others are buying properties and flipping them quickly. The top player in the market, Invitation Homes, which was offloaded by Blackstone in 2019, currently owns 83,000 properties in the U.S. Investors purchased 33% of residential properties in January of this year alone.

It’s no wonder why buying a home has become nearly impossible for first-time buyers, let alone home buyers that are veterans when it comes to the buying and selling process. Unlike in previous years, the lack of supply has created fierce competition between investors, Wall Street, and individual buyers.

California Lawmakers Take Action

Investor homebuying has raised alarms in California, driving lawmakers and housing advocates to take action.

California is not unfamiliar with high home prices; this has been an issue for a decade in The Golden State. With the median home price hitting $884,890 statewide, the time to act is now, which is exactly what lawmakers are doing.

Source: Norada Real Estate

In April, Democratic assemblyman Christopher Ward introduced the California Housing Speculation Act (AB 1771), also known as the “flip tax”. The bill is designed to discourage the flipping of properties by short-term investors by creating a tax that would be applied to profits from sales of properties that happen within three years of the purchase.

"Speculators are taking gobs of tens of millions of dollars out of our community through the cumulative effect of all these transactions," Ward said in a statement. "That's not fair either because the people that are left struggling are people who get outbid 30 times trying to get into their home."

There’s certainly support for this new bill, as well as some criticism. The pushback comes from investors of course, claiming their practices are sound. There’s also pushback from real estate agents who think that this bill might actually do more harm than good to individual buyers. Their concerns are focused on the fact that the bill does not differentiate large investor groups from owner-occupied buyers.

Individuals that want to own a home for less than three years, or want to fix and flip a home, would be affected by this tax. Big investors tend to have the capital to sit on properties for longer, rent them out, then flip after three years.

On top of this, the bill does not solve the root issue behind high home prices in California, which is a lack of housing supply.

"While we appreciate Chris' objective, ultimately this is a supply issue," said Lori Pfeiler, chief executive of the Building Industry Association of San Diego County in an interview with the LA Times. "We don't have enough homes for sale, inventory is low and anyone thinking of selling their home just won't sell their home; they'll figure out how to hold on to it."

The CE Shop readers: What are your thoughts? Do you think the California Housing Speculation Act (flip tax) will discourage investors from purchasing homes with the intent to flip? Why or why not? Let us know in the comments!

The content provided on this website is deemed accurate at the time of creation.

Comments